If you’ve ever thought “The unit price looks great—but why is my total cost so much higher?”, you’re not alone. Many buyers underestimate the true landed cost of importing hats like fedoras from China. It’s not just the product price—it’s everything else layered in: shipping, duties, packaging, bank fees, compliance, and more.

To calculate the true cost of importing fedoras, you must combine EXW/FOB price, freight, customs duties, clearance fees, inland transport, and all hidden charges to determine the per-unit landed cost.

Whether you're an Amazon seller, fashion brand, or hat distributor, this article will walk you through a complete formula to estimate total import cost accurately.

What Are the Core Cost Elements Beyond Unit Price?

When buyers hear “$2.40 per fedora,” they often think that’s the full cost. But that’s just the starting point. To avoid surprises, you need to calculate all actual fees across the supply chain.

Key import cost layers include FOB/EXW price, freight, import duties, clearance, port fees, and inland logistics.

What Are the Standard Cost Elements?

| Cost Component | Description |

|---|---|

| EXW/FOB Price | Product cost at factory |

| Sea/Air Freight | Shipping from China port to your destination |

| Import Duties & Tariffs | Customs % + handling fees |

| Port Charges | Destination terminal charges (DTHC) |

| Customs Clearance Agent | Broker or self-declared fees |

| Inland Trucking | Delivery from port to warehouse |

| Packaging & Labels | Outer carton, hang tags, insert cards |

| Bank Charges | Transfer or forex conversion fees |

Websites like ImportYeti or Alibaba Trade Assurance often list product prices, but not these total landed costs.

How Do You Calculate Duties and Tariffs for Fedoras?

The tariff code you use affects how much tax you pay when importing. Fedoras are categorized under HS Code 6504.00, which covers felt and non-knitted headwear.

Import duties for fedoras vary by country, ranging from 0% (EU) to 15% (US MFN), with extra anti-dumping risk in some cases.

What Is the HS Code and US Rate?

- HS Code: 6504.00.90.00 (Felt or non-knitted headwear)

- US MFN Tariff: Typically 13.2–15%

- EU Duty: Often 0% under GSP + VAT

- Canada: 10.5%

- Russia/CIS: 5–12% depending on origin

You can check current duties on HTSUS for the US, or Access2Markets for the EU.

What Other Fees May Apply?

- Anti-dumping duties (rare, for synthetic felts)

- FDA or CPSIA checks (if hats are for kids)

- WRO/CBP holds if supply chain risk is flagged

To avoid customs delays, we always declare true composition and HS code, along with packing lists and COO docs.

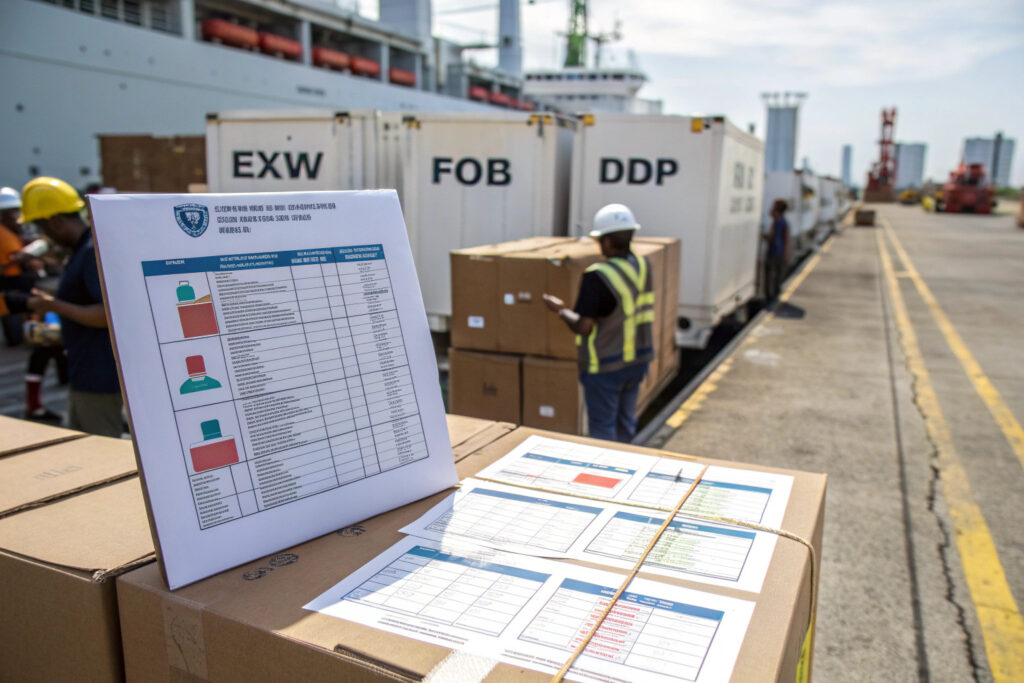

What Is the Cost Difference Between FOB, EXW, and DDP Terms?

Trade terms determine who pays what during transit. They are the blueprint for cost-sharing—and choosing the right term can save or cost you hundreds per shipment.

FOB includes inland delivery to port; EXW doesn’t. DDP includes all taxes and shipping to your door but often with markup.

What’s the Per-Carton Cost Impact?

| Term | What’s Included | Risk | Cost Impact |

|---|---|---|---|

| EXW | Product at factory door | Buyer | Cheapest but complex |

| FOB | Product + delivery to China port | Shared | Most common |

| CFR | Product + ocean freight | Buyer | Adds $300–$800 |

| DDP | All-inclusive, to your warehouse | Seller | Convenient, higher price |

Let’s say you're importing 3,000 fedoras. On EXW, you’ll coordinate pickup. On FOB, we deliver to Ningbo port. With DDP, we quote $3.60–$3.85 per hat delivered to LA/NYC door.

You can read more about incoterm cost impacts at Flexport or Shapiro.

How to Calculate True Per-Unit Landed Cost?

Once you know all the elements, you can plug them into a simple calculator to estimate true cost per unit—including all “invisible” fees.

To get true unit cost, divide the sum of all charges by total sellable units (after damage, shrinkage, etc.).

Sample Landed Cost Breakdown (3,000 Units to US):

| Cost Element | Total | Per Unit |

|---|---|---|

| FOB Unit Price | $2.30 | $2.30 |

| Sea Freight | $700 | $0.23 |

| Duty (15%) | $1,035 | $0.34 |

| Port + Trucking | $540 | $0.18 |

| Labels & Packaging | $300 | $0.10 |

| Bank Fees | $90 | $0.03 |

| Total Landed Cost | $4.28 | $4.28 |

Use Excel or platforms like EasyCargo to manage freight dimensions and Zonos for cross-border pricing.

What Variables Can Change Per Shipment?

- Container availability

- Seasonal port congestion

- Oil/fuel surcharge

- Packaging material cost (especially recycled types)

Our job as your supplier is to forecast those risks and keep you updated.

Conclusion

Importing fedoras from China doesn’t stop at factory pricing—it starts there. To stay profitable and plan accurately, you need to calculate the true landed cost: that includes duties, logistics, and hidden extras.

At Global-Caps, we help clients like Ron build clear cost sheets before production starts. From trade term choice to customs declarations, we make sure your hats arrive exactly how and when you need—at a price that reflects the full journey.