Importing hats from China can present complex tariff challenges that significantly impact your bottom line. Many importers face unexpected costs due to misclassification, changing trade policies, or incomplete understanding of import regulations. Proper planning and knowledge can prevent these costly surprises.

The key to avoiding tariff surprises lies in understanding correct HS code classification, utilizing preferential trade agreements, implementing strategic sourcing practices, and maintaining proper documentation. These elements work together to create predictable, optimized import costs.

Mastering these import strategies will help you navigate the complex landscape of international trade while minimizing unexpected expenses and ensuring compliance with customs regulations.

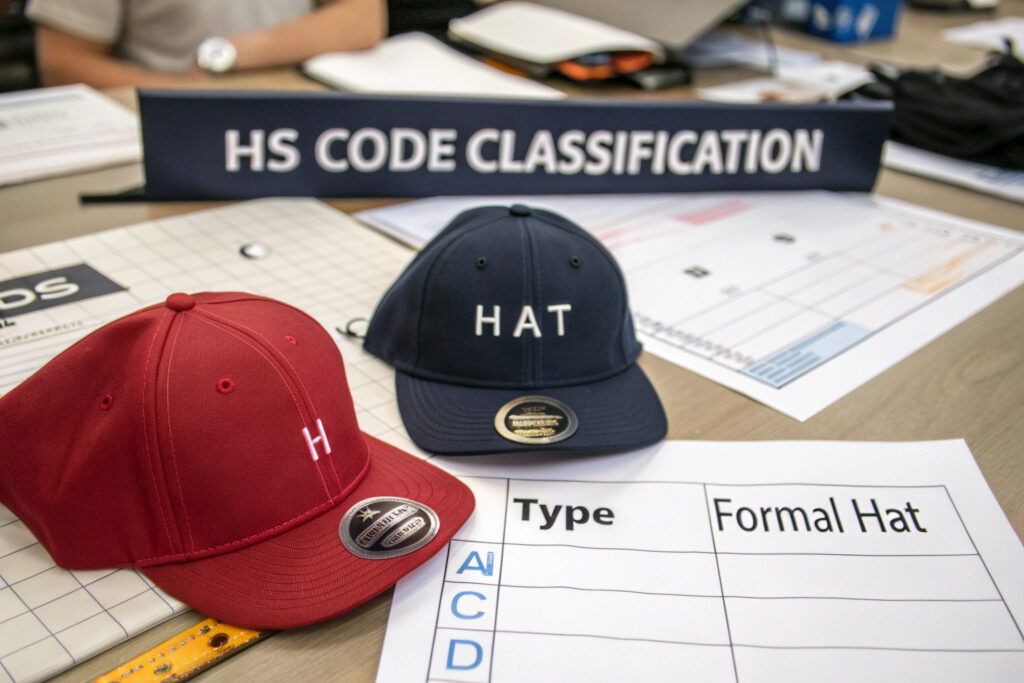

What Are the Correct HS Codes for Different Hat Types?

Proper HS code classification is the foundation of predictable import costs. Misclassification represents the most common cause of tariff surprises and can lead to significant penalties and delayed shipments.

Different hat types fall under specific HS codes with varying duty rates. Understanding these classifications ensures accurate cost calculation and prevents customs delays.

How to Classify Knitted and Crocheted Hats?

Knitted and crocheted hats fall under specific HS codes that differ from woven headwear. Understanding these distinctions is crucial for accurate duty assessment.

Most knitted hats, including beanies and stretch-fit caps, typically classify under HS code 6505.90, which covers "Hats and other headgear, knitted or crocheted." This category generally carries a duty rate of 5.6% to 7.8% depending on the specific material composition. The distinction between knitted and crocheted fabrics is critical - knitted fabrics interloop yarns in rows, while crocheted fabrics create interconnected loops. Our classification experts verify the stitch structure and fabric construction to ensure proper categorization. For hats containing elastic materials or multiple fiber types, we conduct fiber content analysis to determine the predominant material by weight.

What Codes Apply to Structured and Specialty Hats?

Structured hats and specialty headwear require different classifications based on their construction, materials, and intended use.

Baseball caps and other structured hats typically fall under HS code 6504.00 for "Hats and other headgear, plaited or made by assembling strips of any material." This category carries duty rates from 4.5% to 8.5%. Formal hats like fedoras and panama hats may classify under HS code 6504.00 or specific subheadings based on their primary material composition. Specialty hats with technical features like UV protection or moisture-wicking properties require additional documentation to support their classification. We maintain a comprehensive classification database that tracks binding rulings and classification decisions to ensure consistent, accurate categorization across all hat types.

How Can Preferential Trade Agreements Reduce Costs?

Preferential trade agreements offer significant duty savings for qualified imports. Understanding and utilizing these agreements can dramatically reduce your import costs.

Various trade programs provide reduced or eliminated duties for hats imported from China when specific criteria are met.

What De Minimis Benefits Apply to Small Shipments?

The de minimis provision allows low-value shipments to enter the United States duty-free, providing significant savings for small importers and e-commerce businesses.

Currently, the de minimis value for most shipments is $800, meaning hats with a declared value below this threshold generally enter duty-free. This provision particularly benefits e-commerce businesses and small batch importers who ship directly to consumers. However, certain restrictions apply to textile products and regulated materials, so consultation with customs experts is recommended. Our logistics team helps clients structure shipments to maximize de minimis benefits while maintaining compliance with CBP regulations. We also ensure proper valuation methods are applied to prevent challenges from customs authorities.

How Does Section 321 Help E-commerce Importers?

Section 321 of the Trade Facilitation and Trade Enforcement Act provides specific benefits for low-value shipments, particularly benefiting e-commerce hat importers.

This provision allows qualified shipments valued at $800 or less to enter with minimal formalities and without payment of duties or taxes. For hat importers, this means significant savings on small quantity orders and sample shipments. The program requires proper documentation and advance electronic data submission. Our e-commerce specialists help clients implement compliant processes for Section 321 shipments, including proper product valuation and description accuracy. We also ensure clients understand the limitations and restrictions that apply to certain hat materials and constructions.

What Documentation Prevents Customs Delays?

Complete and accurate documentation is essential for smooth customs clearance and predictable import costs. Missing or incorrect paperwork represents a primary cause of delays and unexpected expenses.

Proper documentation ensures compliance, facilitates accurate duty assessment, and prevents costly customs holds.

What Information Must Commercial Invoices Contain?

Commercial invoices serve as the primary document for customs valuation and classification. Incomplete or inaccurate invoices frequently cause clearance delays and duty miscalculations.

Required information includes detailed product descriptions, accurate HS codes, complete value declarations, and proper country of origin markings. For hats, specific details like material composition, construction methods, and manufacturing processes must be clearly stated. Our documentation team verifies all invoice elements against CBP requirements and includes supporting documents like mill certificates for textile products. We also ensure proper incoterms application and currency conversion accuracy.

How Do Certificates of Origin Impact Duty Rates?

Certificates of origin determine eligibility for preferential duty rates under various trade agreements and affect the application of special tariffs.

While most hats from China don't qualify for preferential origin status under current trade conditions, proper origin documentation remains essential for compliance. The USMCA and other trade agreements require specific certificate formats and verification procedures. For hats containing materials from multiple countries, we provide detailed substantial transformation analysis to support origin claims. Our documentation includes manufacturer affidavits and production records that verify origin claims and support customs valuation.

What Sourcing Strategies Minimize Tariff Impact?

Strategic sourcing decisions can significantly reduce tariff exposure while maintaining product quality and supply chain reliability.

Implementing smart sourcing practices helps optimize costs while ensuring compliance with evolving trade regulations.

How Does Material Selection Affect Duty Rates?

Material composition significantly impacts duty rates for hats, making strategic material selection an important cost optimization tool.

Hats made from different materials face varying duty rates under the Harmonized Tariff Schedule. For example, hats with plastic components may have different rates than those made primarily from textile materials. Our sourcing specialists analyze material options based on both cost and duty implications, often identifying alternatives that maintain quality while reducing tariff exposure. We also consider sustainable material options that may qualify for environmental trade programs or reduced rate categories. The fiber content percentage can trigger different classification, making precise material documentation essential for accurate duty assessment.

What Role Does Supplier Location Play in Tariff Calculation?

Supplier location within China can impact total landed costs through regional incentives, logistics efficiency, and special economic zone benefits.

Manufacturers located in special economic zones may offer advantages through export processing regulations and value-added tax benefits. Our supplier network includes partners in key manufacturing clusters like Zhejiang and Guangdong that understand export requirements and maintain compliance expertise. We also consider logistics factors like proximity to major ports and consolidation opportunities that can reduce overall shipping costs. The supplier's experience with US import regulations significantly impacts the smoothness of customs clearance and accuracy of duty assessment.

Conclusion

Successfully importing hats from China without tariff surprises requires comprehensive knowledge of classification systems, strategic use of trade provisions, meticulous documentation, and smart sourcing decisions. By implementing these practices, importers can achieve predictable costs while maintaining compliance with complex customs regulations.

The most successful import strategies combine technical expertise with practical logistics knowledge, creating efficient supply chains that minimize unexpected expenses and maximize profitability.

Ready to optimize your hat imports from China with predictable tariff outcomes? Contact our Business Director Elaine today to discuss strategic sourcing and import planning. Her email is elaine@fumaoclothing.com. Let's build an import strategy that eliminates surprises and maximizes your competitive advantage.