Calculating the true cost of a hat involves more than simply adding material and labor expenses. Many manufacturers and brands underestimate their total costs by overlooking hidden expenses like overhead allocation, shipping, compliance testing, and minimum order quantity implications. Understanding comprehensive cost calculation is essential for pricing strategies that ensure profitability while remaining competitive.

The total cost of a hat includes direct materials, labor, factory overhead, shipping and logistics, import duties, compliance testing, and a profit margin that accounts for business sustainability. Different hat styles and materials significantly impact these cost components, requiring customized calculation approaches for accurate pricing.

Proper cost calculation enables informed decisions about material selections, manufacturing locations, order quantities, and retail pricing strategies that support business growth rather than undermining it through hidden cost underestimation.

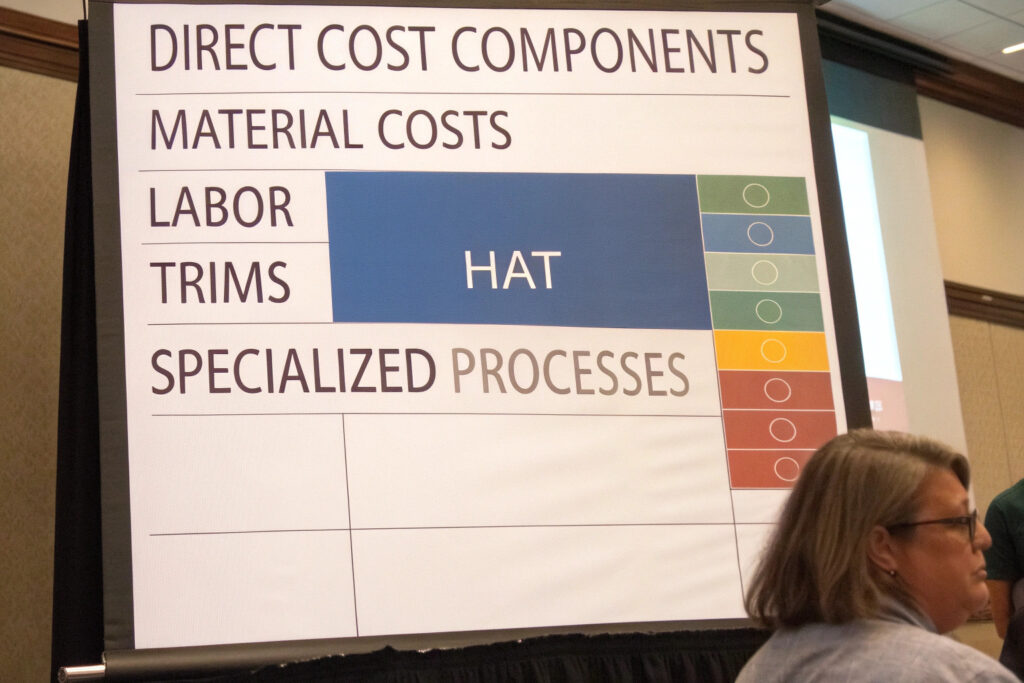

What Are the Direct Cost Components?

Direct costs represent the expenses directly attributable to producing each hat. These vary significantly based on materials, construction complexity, and manufacturing location. Understanding these variables helps identify cost optimization opportunities without compromising quality.

Direct costs encompass raw materials, trims and components, direct labor, and any specialized processes required for specific hat styles. Each element must be calculated precisely to establish accurate baseline production costs.

How Do Material Choices Impact Base Cost?

Material selection typically represents 35-60% of a hat's total production cost, with significant variation between basic cotton, technical fabrics, and premium materials. Each material choice carries implications for both cost and perceived value.

We calculate material costs based on:

- Fabric type and weight (cotton, wool, technical blends, straw)

- Material consumption based on pattern efficiency and cutting waste

- Special treatments (water resistance, UV protection, antimicrobial)

- Minimum purchase quantities and price breaks at different volumes

- Supplier location and shipping costs to factory

According to Textile Cost Analytics, material costs for hats range from $0.85 for basic cotton caps to $8.50+ for premium wool felts or technical performance fabrics. Our material sourcing platform tracks real-time fabric pricing across different regions, enabling accurate material cost projections during product development.

What Labor Factors Influence Production Cost?

Labor costs vary dramatically based on manufacturing location, hat complexity, and production methods. Understanding these variables helps match hat styles with appropriate manufacturing partners.

We analyze labor costs through:

- Regional wage differences (China: $450-750/month, Vietnam: $300-500/month, USA: $2,500-4,000/month)

- Production time per hat (basic baseball cap: 12-18 minutes, structured fedora: 45-60 minutes)

- Skill level requirements for different construction techniques

- Efficiency rates based on factory experience with specific hat types

- Quality control time as percentage of production labor

The International Labor Organization provides regional wage data that informs our labor cost calculations. Our manufacturing partners provide detailed time studies for each hat style, enabling precise labor cost allocation rather than rough estimates.

What Indirect Costs Must Be Included?

Indirect costs often get overlooked in initial cost calculations but significantly impact total landed cost. These expenses must be allocated appropriately across production runs to avoid eroding profit margins.

Indirect costs include factory overhead, tooling and setup, compliance testing, shipping and duties, and administrative expenses. Proper allocation requires understanding production volumes and cost drivers for each category.

How Should Factory Overhead Be Calculated?

Factory overhead includes all production expenses not directly tied to specific hats, including electricity, equipment depreciation, management salaries, and facility costs. These must be allocated based on realistic production capacity.

We allocate overhead using:

- Monthly factory operating costs divided by production capacity

- Machine depreciation schedules based on equipment usage

- Administrative staff ratios to production workforce

- Facility costs per square meter of production space

- Utilities consumption correlated with production volume

The Apparel Production Management Association recommends overhead rates of 25-40% of direct labor costs, depending on factory automation and efficiency. Our manufacturing partners provide transparent overhead breakdowns that ensure accurate allocation rather than arbitrary percentage markups.

What Compliance and Testing Costs Should Be Anticipated?

Compliance requirements vary by target market and materials used, with testing costs that must be amortized across production runs. These expenses ensure market access and mitigate liability risks.

We budget for compliance costs including:

- OEKO-TEX Standard 100 testing ($300-600 per material combination)

- CPSC compliance testing for children's products ($1,200-2,500)

- REACH/SVHC compliance for European markets ($400-800)

- Fabric performance testing (colorfastness, shrinkage, etc.: $150-300 per test)

- Product safety certification (CE marking, UL certification: $500-2,000)

According to Global Compliance Center data, compliance testing adds $0.15-0.85 per hat depending on order quantity and testing requirements. Our compliance management system helps clients identify mandatory versus optional testing to optimize these necessary expenses.

How Do Shipping and Duties Impact Total Cost?

Shipping and import duties often surprise new importers with their significant impact on total landed cost. These expenses vary based on shipment method, volume, and trade agreements between manufacturing and destination countries.

International logistics costs include ocean or air freight, insurance, customs brokerage, port fees, and import duties. Each element requires careful calculation to avoid cost underestimation.

What Shipping Method Provides Optimal Cost Balance?

Shipping method selection involves balancing speed against cost, with different approaches suitable for different order sizes and urgency requirements. The optimal choice depends on hat value, volume, and sales cycle timing.

We calculate shipping options including:

- Air freight (5-10 days, $4.50-8.00/kg, best for samples and urgent small orders)

- Sea freight (25-40 days, $0.85-1.75/kg, optimal for production quantities)

- Express courier (3-7 days, $6.50-12.00/kg, suitable for small urgent shipments)

- Consolidated shipping (combining with other importers for volume discounts)

- Bonded warehouse strategies for duty optimization

The International Freight Forwarders Association provides current shipping rate benchmarks that inform our logistics planning. Our shipping optimization platform analyzes order characteristics to recommend the most cost-effective shipping method for each situation.

How Should Import Duties Be Calculated?

Import duties vary by country of origin, materials used, and destination market. Understanding harmonized system codes and trade agreements is essential for accurate duty calculation.

We structure duty optimization through:

- Correct HS code classification (6505.90.90 for most knitted/crocheted hats)

- Preferential trade agreements (reduced rates for certain country pairs)

- First sale rule application where legally permissible

- Duty drawback programs for re-export scenarios

- Material-specific duty rates (different for cotton, synthetic, wool)

According to World Trade Organization data, hat import duties range from 0% under preferential trade agreements to 16-20% for standard most-favored-nation rates. Our duty optimization service helps clients structure sourcing to minimize duty impacts while maintaining compliance.

What Profit Margin Considerations Ensure Sustainability?

Profit margin must account for both business sustainability and market competitiveness. Too little margin undermines business viability, while too much makes products uncompetitive. Strategic margin structures vary by sales channel and business model.

Sustainable margin calculation includes cost of goods sold, operational expenses, risk factors, payment terms impact, and strategic positioning within the market.

How Do Sales Channels Influence Margin Requirements?

Different sales channels have distinct cost structures that necessitate varying margin levels to achieve profitability. Understanding these differences prevents underpricing in certain channels while remaining competitive in others.

We analyze channel-specific margins including:

- Wholesale distribution (40-60% margin required to cover sales costs)

- Direct retail (60-75% margin needed for brick-and-mortar operations)

- E-commerce (50-65% margin accounting for platform fees and marketing)

- Promotional products (30-50% margin with volume-based pricing)

- Private label (40-55% margin for custom manufacturing)

The Fashion Business Association provides industry-specific margin data that informs our pricing recommendations. Our channel margin calculator helps clients develop appropriate pricing across different sales approaches while maintaining consistent brand positioning.

What Risk Factors Should Margin Cover?

Profit margin must account for business risks beyond immediate costs, including inventory obsolescence, payment defaults, currency fluctuations, and competitive pressures. These risk factors vary by business model and market position.

We incorporate risk factors through:

- Inventory carrying costs (2-4% monthly for storage, insurance, capital)

- Payment default reserves (1-3% of revenue for bad debt)

- Currency fluctuation buffers (3-5% for import-based businesses)

- Product return allowances (2-8% depending on sales channel)

- Competitive response flexibility (5-10% for promotional pricing capability)

According to Fashion Risk Management studies, successful apparel businesses maintain gross margins 15-25% above their direct costs to account for these risk factors. Our risk-adjusted pricing model ensures clients build appropriate buffers without sacrificing competitiveness.

Conclusion

Accurate hat cost calculation requires comprehensive analysis of direct materials, labor, overhead allocation, shipping, duties, compliance, and sustainable profit margins. Each component demands careful evaluation based on specific hat styles, materials, manufacturing locations, and sales channels.

The most successful hat businesses develop detailed cost models that account for all expense categories while maintaining flexibility to adapt to changing material costs, shipping rates, and market conditions. This thorough approach prevents the common pitfall of underestimating true costs and eroding profitability through incomplete calculation.

Ready to develop accurate cost calculations for your hat line? Contact our Business Director Elaine to discuss how our costing expertise and manufacturing partnerships can help you build sustainable pricing strategies. Her email is elaine@fumaoclothing.com. Let's ensure your hat business achieves both market success and financial health through proper cost understanding.